c

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number:

(Exact name of registrant as specified in its charter)

|

||

(State or Other Jurisdiction |

|

(IRS Employer |

|

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code:

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of the voting common equity held by non-affiliates of the Registrant, computed by reference to the last reported price at which the Registrant’s common equity was sold on June 30, 2022 (the last day of the Registrant’s most recently completed second quarter) was $

On February 27, 2023, the Registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its 2023 Annual Meeting of Stockholders are incorporated by reference in this report in response to Part III, Items 10, 11, 12, 13, and 14 which will be filed no later than 120 days after the Registrant’s fiscal year ended December 31, 2022.

COMMONLY USED DEFINED TERMS

As used in this annual report, unless the context indicates or otherwise requires, the following terms have the following meanings:

Information Concerning Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated costs, expenditures, cash flows, growth rates and financial results, our plans, anticipated amount and timing of cost savings relating to the restructuring plan, and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

We derive many of our forward-looking statements from our operating budgets and forecasts that are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual

results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our filings with the SEC and other public communications. You should evaluate all forward-looking statements made in this Annual Report in the context of these risks and uncertainties.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Table of Contents

i

PART I

Item 1. Business

Overview

Founded by Patrick G. Ryan in 2010, Ryan Specialty is a service provider of specialty products and solutions for insurance brokers, agents, and carriers. We provide distribution, underwriting, product development, administration, and risk management services by acting as a wholesale broker and a managing underwriter with delegated authority from insurance carriers. Our mission is to provide industry-leading innovative specialty insurance solutions for insurance brokers, agents, and carriers.

For retail insurance brokers, we assist in the placement of complex or otherwise hard-to-place risks. For insurance carriers, we work with retail and wholesale insurance brokers to source, onboard, underwrite, and service these same risks. A significant majority of the premiums we place are bound in the E&S market, which includes Lloyd’s of London, which we refer to as Lloyd’s. There is often significantly more flexibility in terms, conditions, and rates in the E&S market relative to the Admitted or “standard” insurance market. We believe that the additional freedom to craft bespoke terms and conditions in the E&S market allows us to best meet the needs of our trading partners, provide unique solutions, and drive innovation. We believe our success has been achieved by providing best-in-class intellectual capital, leveraging our trusted and long-standing relationships, and developing differentiated solutions at a scale unmatched by many of our competitors.

Our plan for continued growth includes positioning ourselves as a pioneer in ever-changing markets, attracting and developing industry-leading talent, broadening our product offerings organically and inorganically, and further entrenching our deep industry relationships. We have been successful in each of these areas through our relentless focus on serving each of our key constituents:

Who We Are

We are the second-largest U.S. P&C insurance Wholesale Broker, according to premium volume reported in the 2022 Business Insurance broker rankings Special Report. Our distribution network encompasses over 680 individuals directly responsible for revenue generation in either Wholesale Brokerage or Binding Authority (each, a “Producer” and together, the “Producers”) who provide us access to over 17,000 retail insurance brokerage firms and over 200 insurance carriers. We are compensated for providing services primarily by commissions and fees.

Our business was founded to address the growing need for specialists in the increasingly important E&S market. For the year ended December 31, 2022, 74% of the total premiums we placed were in the E&S market. The growing relevance of the E&S market has been driven by the rapid emergence of large, complex and high-hazard risks across many lines of insurance. This trend continued in 2022, with 14 named storms – including Hurricane Ian with estimated losses of $50 to $65 billion during the 2022 Atlantic hurricane season – following 21 named storms

1

totaling over $70 billion in estimated losses during the 2021 Atlantic hurricane season, escalating jury verdicts and social inflation, a proliferation of cyber threats, novel health risks, and the transformation of the economy to a “digital first” mode of doing business.

Compared to Admitted carriers, E&S insurance carriers often have more flexibility to quickly adjust coverage terms, pricing, and conditions in response to market needs and dynamics. This practice is commonly referred to as “freedom of rate and form,” which can facilitate coverage that would not otherwise be attainable. With greater flexibility, E&S underwriters can tailor insurance products to meet emerging risks, the needs of insureds, and the risk appetite of insurance carriers. As a result, the emergence of complex, unique or otherwise hard-to-place risks, and the need for specialty solutions, have driven meaningful growth within the E&S market.

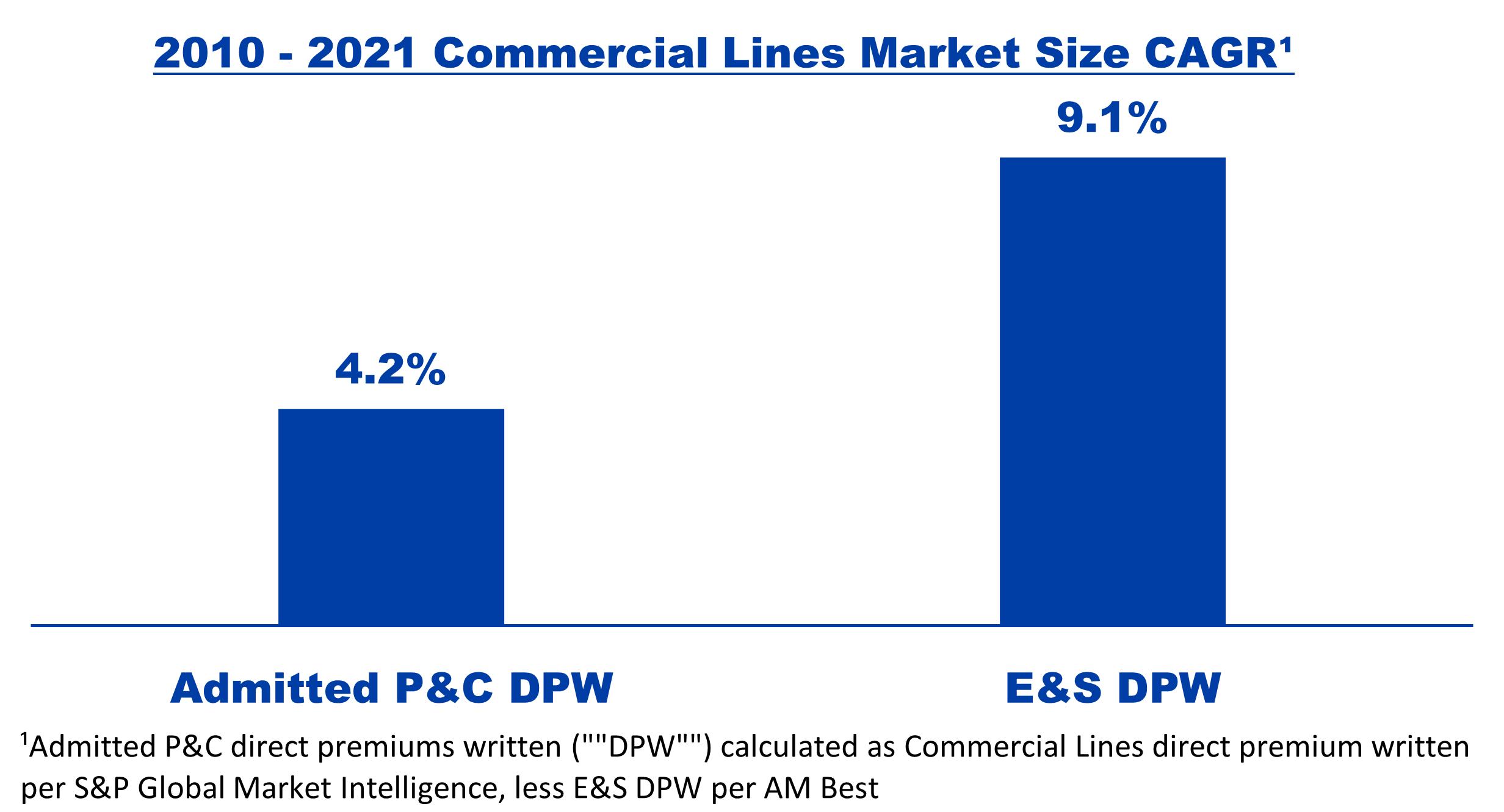

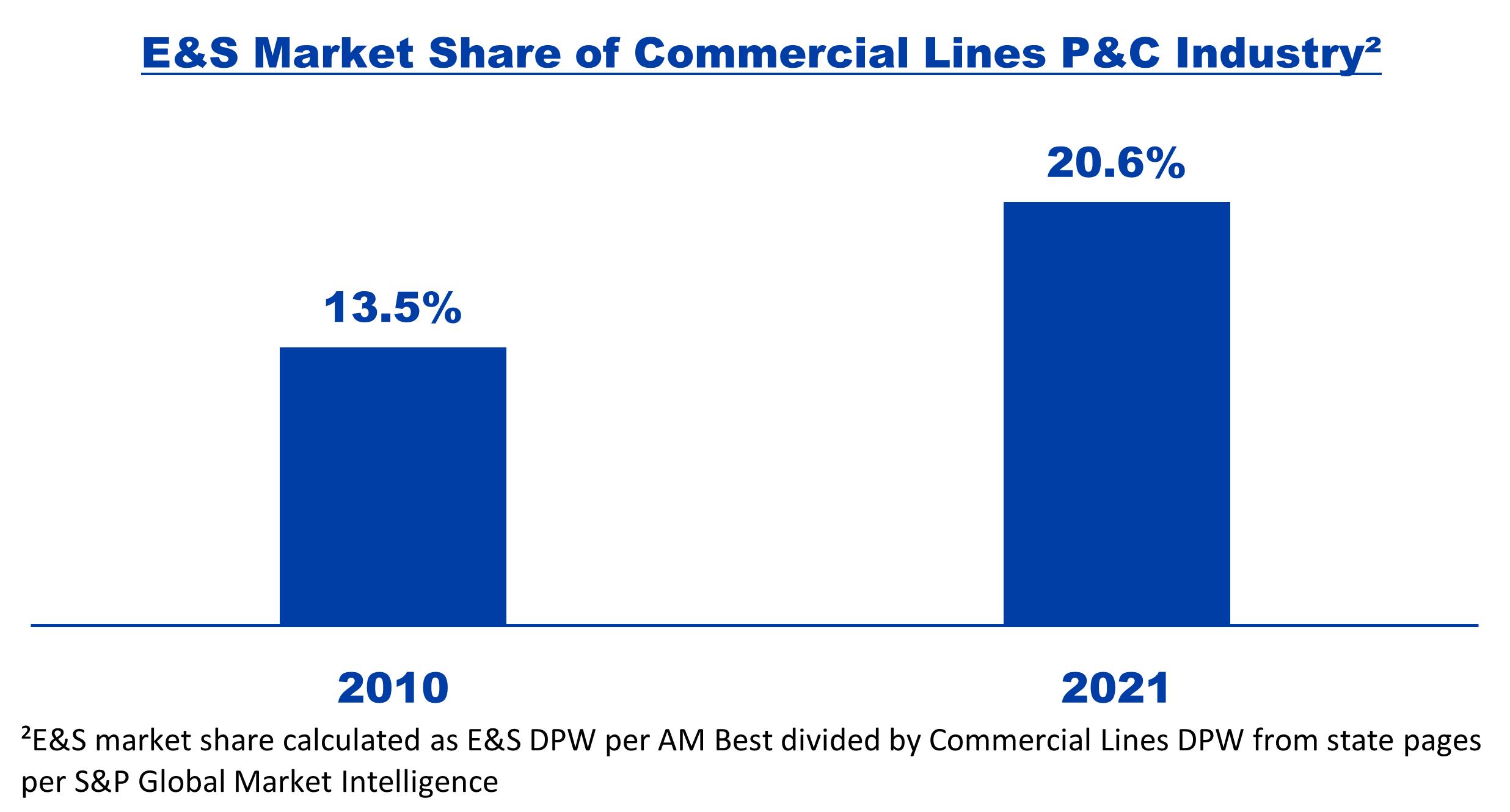

Based on data from AM Best, the U.S. E&S market (which comprised $83 billion of direct written premium in 2021) has grown at a CAGR of 9.1%, compared to 4.2% for the U.S. Admitted market, between 2010 and 2021. E&S market share as a percentage of total U.S. commercial insurance premium increased from 13.5% in 2010 to 20.6% in 2021. We believe the higher rate of growth of the E&S market is due to the shift towards complex risks, insulating the E&S market from broader economic trends. We expect that this trend will continue.

We have been able to increase our market share by offering custom solutions and products to better address changing market fundamentals. Historically, smaller wholesale insurance brokers have relied on a go-to-market strategy that is primarily predicated on facilitating access to underwriting capacity. As risks in the E&S market continue to become more complex, increasingly global and higher hazard, simply offering market access to retail insurance brokers is no longer sufficient. We believe that as risks become more complex, the E&S market will continue to increase, wholesale brokers that do not have sufficient scale or the financial and intellectual capital to invest in the required specialty capabilities will struggle to compete effectively. This dynamic will continue the trend of market share consolidation among the wholesale insurance brokers that have these capabilities.

Our growth has been further supported by the rapid consolidation among retail insurance brokers and the consolidation of their wholesaler trading partner relationships. During 2022, retail insurance brokers completed 987 merger and acquisition (“M&A”) transactions during the preceding twelve-month period according to OPTIS Partners, compared to 1,034 in 2021, 795 in 2020, and 206 in 2010. According to Business Insurance, this M&A velocity contributed to the Top 100 retail brokers growing revenue by over 19% in 2021. As retail brokers have become larger, they have looked to establish relationships with fewer, more trusted wholesale brokers. This approach, commonly known as “wholesale panel consolidation,” ensures that the retail brokers have quality, clarity, and consistency across their operations and insurance placement. The trend of wholesale panel consolidation started in 2011 among global retail insurance brokers and was subsequently replicated by middle-market retail brokers. We believe that retail insurance brokers favor having us on their wholesale panels as a preferred trading partner because we have national scale, top-flight talent, a full suite of product solutions, and are free from channel conflicts with their retail operations. As retail insurance brokers continue to grow and consolidate their wholesale panels, we expect that the amount of premiums we place from these existing retail broker relationships will grow.

Similarly, there has been meaningful consolidation among P&C insurance carriers over the past decade. This carrier consolidation likewise provided more opportunities for a smaller group of well-positioned insurance specialists best equipped to provide the necessary services with the requisite scale and talent.

2

Our core value proposition to retail insurance brokers and carriers is delivering best-in-class intellectual capital. Our people are our source of intellectual capital. We have sought to attract, develop, and retain many of the most skilled specialty insurance professionals in the industry. We seek to attract leading talent into our organization by offering a purpose-driven culture, a wide range of opportunities for career advancement and a platform for success through the breadth of our retail insurance broker relationships. We have access to over 17,000 retail insurance brokerage firms, including preferred relationships with substantially all of the top 100 retail insurance brokers. We have been highly successful in our recruiting and retention efforts and are a destination of choice for top-tier talent. Since the beginning of 2018, we have recruited 79 Producers who are now responsible for $524 million of annual premiums (figures exclude Producers who are not associated with a discrete book of business). Each of the cohorts of Producers hired between 2016 and 2021 generated revenue which exceeded compensation costs by their second year. Ensuring individual Producer book of business growth is critical for our business as it supports our organic growth, motivates our Producers, and fosters retention. In 2022, our Producer retention rate was 97%. We continue to make significant investments in people. We have formalized our Producer sourcing and development program through the establishment of Ryan Specialty University, allowing us to even more effectively cultivate talent across all specialties. We expect this program will continue to drive growth in the future.

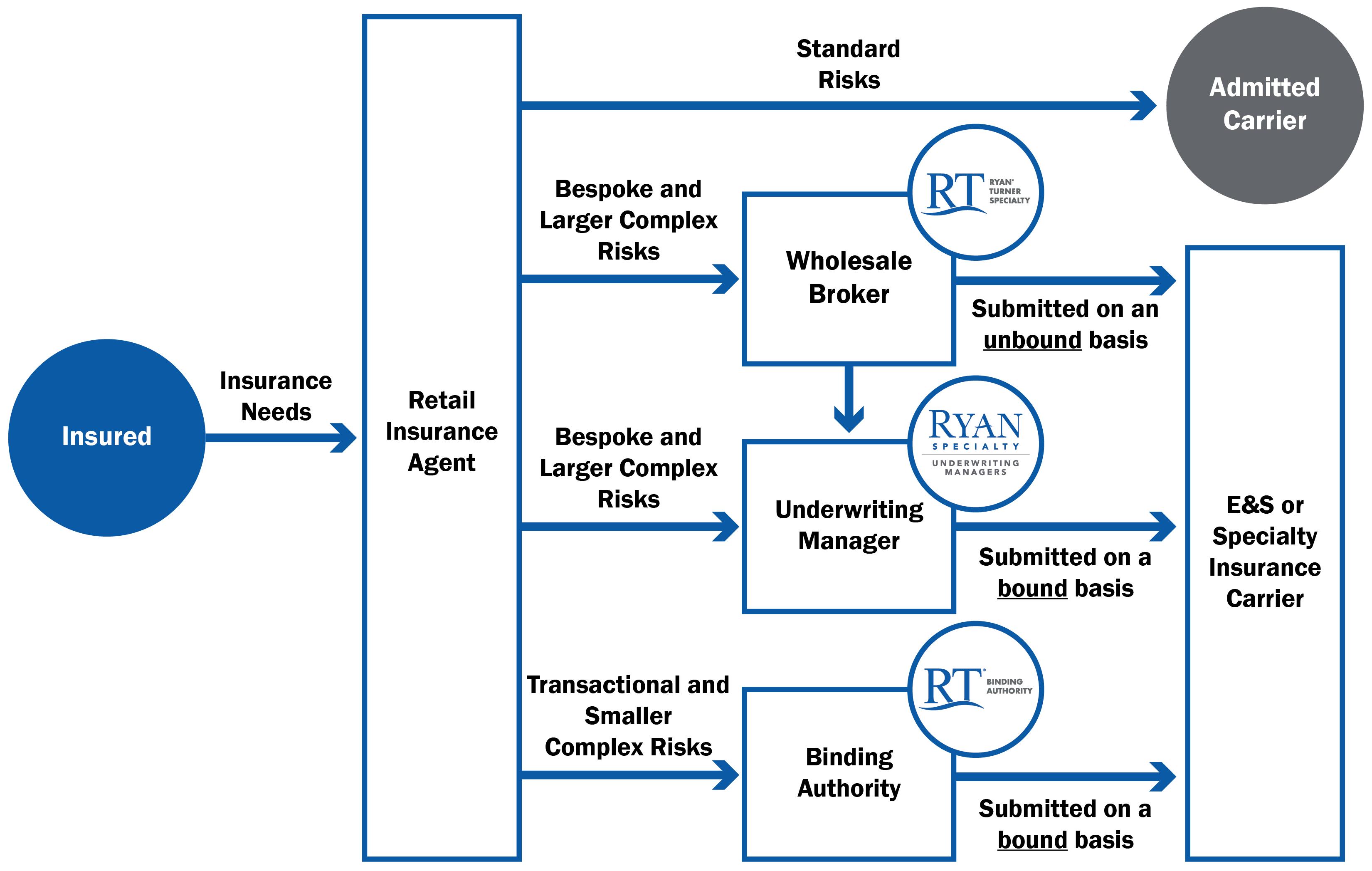

Our Producers are able to offer retail insurance brokers multi-channel access to E&S and Admitted markets through our three Specialties: Wholesale Brokerage, Binding Authority, and Underwriting Management.

We have significantly enhanced our human capital, product capabilities and geographic footprint through strategic acquisitions. Since inception, we have partnered with over 40 firms through acquisition. These firms represent a diverse mix of specialties and geographies, allowing us to better service both existing and prospective trading partners. The targets that we acquired in 2021 and 2020 had revenues for the unaudited twelve-month period prior to acquisition of $34.0 million and $239.7 million, respectively. In January 2023, we acquired certain assets of Griffin Underwriting Services, which had unaudited trailing twelve-month revenues of $23.0 million at the time of

3

acquisition. We are highly selective in our M&A strategy and focus on partners that share our long-term approach, inclusive culture and commitment to integrity and client centricity. We primarily source our acquisitions through proprietary dialogue with potential partners and selectively take part in auction processes in which we believe we have a differentiated approach or value proposition. We take a consistent and disciplined approach to deal structuring and integration in order to best ensure that our partners are positioned to succeed after the acquisition.

We believe that we have a number of competitive advantages in M&A compared to our competition, including robust access to capital, freedom of channel conflict in the retail market with our retail insurance broker clients, the ability to leverage our distribution platform and back-office operations to drive revenue and cost synergies through a systematic approach to integration, and a strong underlying value proposition. We have typically sought to partner with entrepreneurs who are seeking to join a firm that can give them broader product capabilities and enhanced access to retail insurance brokers and carriers. We believe we are the partner of choice for firms and teams seeking to benefit from the resources of a larger organization without sacrificing culture, entrepreneurial spirit, and the desire to grow. We continuously evaluate acquisitions, maintain a robust pipeline, and are currently in active dialogue with several potential new partners. We have previously made, and intend to continue to pursue, acquisitions with the objective of enhancing our human capital, product capabilities, natural adjacencies, and geographic footprint.

Our largest acquisition to date is All Risks, which closed in September 2020. All Risks was the fourth largest wholesale distributor in the United States at the time of the acquisition, according to Business Insurance’s 2020 rankings. All Risks possessed all of the key attributes we sought in an acquisition partner: it had a track record of strong organic revenue growth, enhanced our market presence, was accretive to our talent base, complementary in products and geography, and possessed a high-quality management team that was both aligned with our culture and sought to remain active in the business. Members of the executive team who joined as part of the All Risks Acquisition are now leading our efforts to further develop both our national, fully integrated Binding Authority Specialty and our program platform, the latter of which is part of our Underwriting Management Specialty. We believe these capabilities complement our Wholesale Brokerage Specialty by enhancing access to specialized product offerings across our business and driving growth. All Risks is a natural fit within our Company as demonstrated by our excellent Producer retention; since the All Risks Acquisition was completed, as of December 31, 2022, retention has been consistent with Ryan Specialty's historical retention.

The All Risks Acquisition advanced many of our strategic priorities, including leveraging technology to drive both productivity and efficiency. As an expert in binding authority, All Risks is able to cost-efficiently secure coverage for smaller-premium policies through its best-in-class operating model that drives efficiency and eliminates unnecessary data entry and duplicative work. We are on track to complete the merger of the binding authority service model, technology platform, and premium scale of All Risks with our differentiated technology platform, The Connector, in 2023.

The Connector is a digital marketplace through which our retail clients and internal producers can receive quotes and bind policies online. It can produce multiple bindable quotes sourced from high-quality E&S carriers across several risk classes in minutes. In cases when certain risks do not fit into The Connector’s highly automated underwriting criteria, the retail insurance broker is automatically directed to our Producers and underwriters for more traditional placement methods. This holistic approach and integrated service model allow us to better serve retail insurance brokers because we can place their smaller-premium accounts efficiently, aggregate more of their submissions rapidly, and bind more policies for them cost-effectively. We have also connected with several “digital first” retail trading partners as a wholesale digital distributor. Under these arrangements, policies that do not fit our trading partner’s Admitted markets platform are referred directly into The Connector platform for access to E&S solutions.

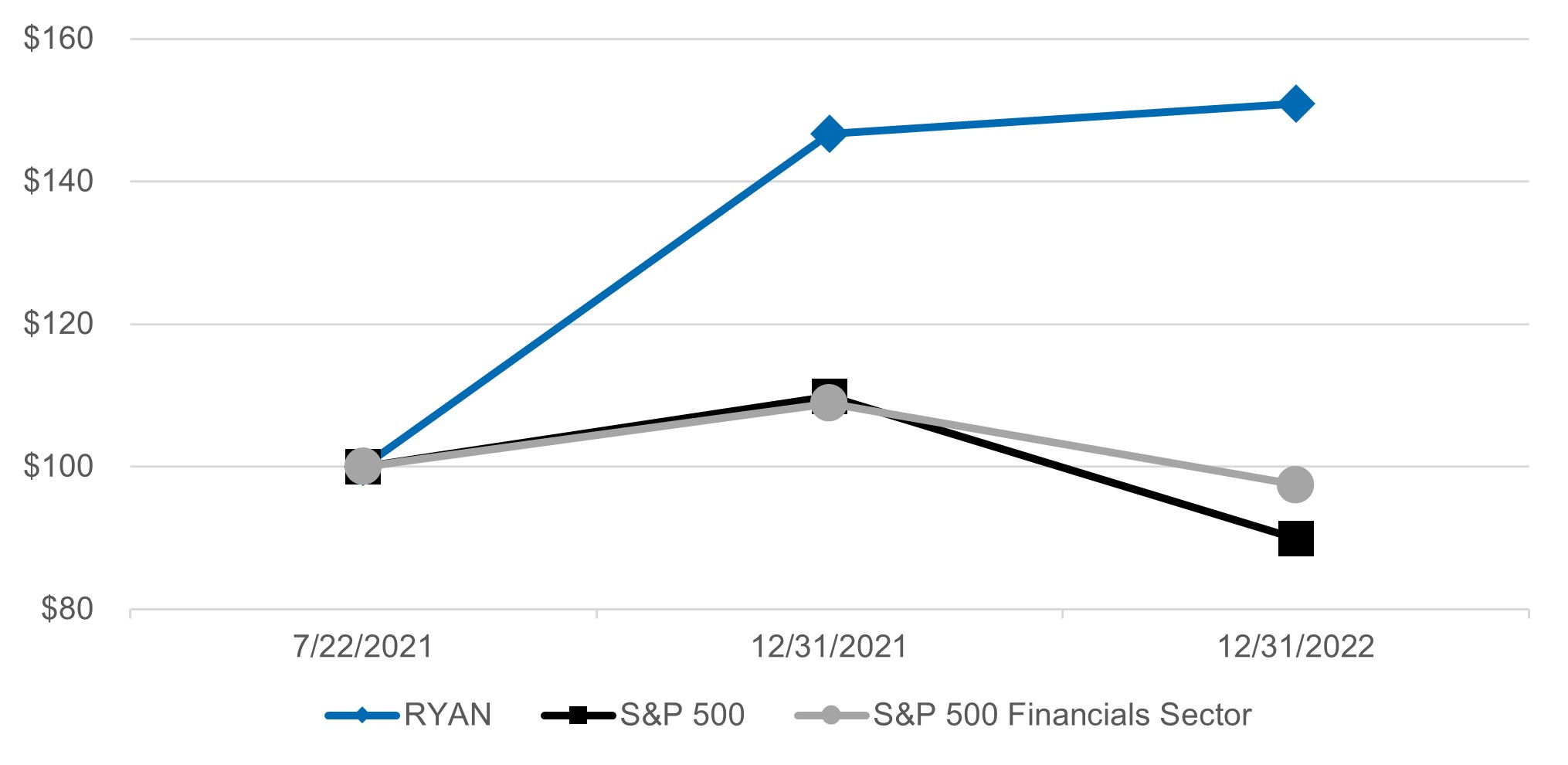

Our financial performance reflects the strength of our strategy and business model, including a 20.4% and 40.7% increase in revenue from year ended December 31, 2021 to December 31, 2022 and year ended December 31, 2020 to December 31, 2021, respectively. This rapid pace of growth was accompanied by an increase in Diluted earnings (loss) per share from a diluted loss per share of $0.07 in 2021, related to the post-IPO period, to diluted earnings per share of $0.52 in 2022. Our Adjusted diluted earnings per share also increased from $1.08 in 2021 to $1.15 in 2022. Please see “Note 13, Earnings (Loss) Per Share” in the footnotes to the Consolidated Financial Statements in this Annual Report for additional information. Adjusted diluted earnings per share is a non-GAAP metric. For a reconciliation of Adjusted diluted earnings per share to its most directly comparable GAAP metric,

4

Diluted earnings (loss) per share, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operation – Non-GAAP Financial Measures and Key Performance Indicators.”

Industry Overview

As a wholesale distributor, we operate within the broader P&C insurance distribution market, which comprises both wholesale insurance brokers and retail insurance brokers. Wholesale and retail insurance brokers facilitate the placement of P&C insurance products in both the E&S and Admitted markets.

P&C Insurance Market

Insurance carriers sell commercial P&C products in the United States through one of two markets: the Admitted or “standard” market and the E&S market. Approximately 79% of U.S. premiums are generated through the Admitted market, which has highly regulated rates and policy forms. As a result, products in the Admitted market are relatively uniform in price and coverage. According to data from AM Best, the E&S market comprised $83 billion of direct written premium in 2021. In the E&S market, insurance carriers have more flexibility to customize rates and coverage. This flexibility facilitates the underwriting of risks which are characterized by a complex profile, unique nature, size or are otherwise difficult to place. The overall top five U.S. writers of E&S products in 2021 included: Berkshire Hathaway Inc., American International Group, Inc., Markel Corporation, Fairfax Financial Group, and W.R. Berkley Corporation, with whom we maintain meaningful relationships. Lloyd’s, which represents a market of 90 syndicates, is also a prominent player in the E&S space and approximately 17% of 2021 E&S premiums in the United States was for insurance coverage placed in the Lloyd’s market according to AM Best.

P&C Insurance Distribution Market

P&C insurance distribution is dependent on premium volumes in the P&C market as distributors typically receive a commission based on a percentage of the dollar amount of the premiums placed. The dollar amount of premiums placed is a function of both insurance rates and the underlying amount of coverage purchased, which is affected by broader macroeconomic conditions, capital availability, and carrier loss trends in the class of risk and/or the specific insured. There are broadly two types of insurance distributors: retail distributors (also called retail insurance brokers) and wholesale distributors. Retail insurance brokers source insurance buyers and act as an intermediary between the insurance buyer and insurance carriers. Wholesale distributors act as intermediaries between retail insurance brokers and insurance carriers by assisting in the placement of “specialty” risks that are outside of the retail insurance brokers’ core expertise, complex, high hazard or otherwise hard to place.

Wholesale Insurance Distribution Market

The wholesale insurance distribution market enhances efficiencies for both retail insurance brokers and insurance carriers. Retail insurance brokers rely on wholesale distributors, such as ourselves, to assist in securing insurance coverage for complex or specialty risks. The primary market for these insurance placements is the E&S market, where retail insurance brokers often must utilize wholesaler distributors who have distinct expertise and execution capabilities with specialized carriers. According to AM Best, over the past five years wholesalers were involved in placing approximately 87% to 91% of annual E&S premiums. E&S insurance carriers rely on wholesale insurance distributors for product expertise and distribution capabilities. By leveraging Ryan Specialty as a wholesale distributor, E&S insurance carriers are able to access a national network that includes over 17,000 retail insurance brokerage firms in a highly efficient manner, while simultaneously enhancing the quality of policy submissions by using a knowledgeable counterparty. Insurance carriers also leverage our comprehensive distribution network and deep knowledge to gain timely and cost-efficient access to new risk classes and industries.

Wholesale distributors, who are typically compensated through commissions paid by the insurance carrier, share a portion of these commissions with the retail insurance broker and recognize revenue on a net basis. Wholesale distributors can also receive fees in addition to commissions for placing certain insurance policies. Wholesale distributors generally utilize one of three methods to place insurance risks into the E&S market:

5

The following summarizes the U.S. insurance distribution value chain:

How We Win

We believe our success is attributable to providing best-in-class intellectual capital, leveraging our trusted and long-standing relationships, and developing differentiated solutions at a scale and level of quality unmatched by most of our competitors. These characteristics have allowed us to consistently win business and grow faster than our competition.

Compete with best-in-class intellectual capital and drive consistent innovation: Historically, wholesale distributors simply provided retail insurance brokers with E&S market access. We believe this practice is an antiquated go-to-market approach. The inherent weakness of this model has been illuminated as retail insurance brokers have consolidated and the risks placed into the E&S market have grown larger, more complex and higher hazard. We are able to thrive by not just providing market access, but by also constantly offering differentiated and innovative solutions. Our professionals have extensive industry experience and deep product knowledge, allowing us to develop bespoke solutions in addition to providing distribution. By harnessing our collective knowledge, creativity, and relationships, we offer our clients and trading partners the expertise necessary to pursue new industries and new opportunities in an increasingly complex world. In order to foster our culture of innovation, we focus on recruiting, retaining, and developing the best-in-class wholesale professionals in the industry.

6

Deep connectivity with retail brokerage firms: While we empower our Producers to develop strong relationships with individual retail insurance brokers, we also engage with retail brokerage firms holistically. Our executive management team has long-standing relationships with the leadership teams at numerous retail brokerage firms; many of these relationships pre-date some of our management’s tenure at Ryan Specialty. Reporting to our executive management team are practice leaders who are aligned to the distribution channels within many retail brokerage firms. We employ experienced practice leaders across all broad classes of business, including property, casualty, and professional & executive liability coverages, in addition to specialists who run highly focused distribution channels such as construction, cyber, transportation, renewable energy, professional liability, alternative risk, and transactional liability. Through our comprehensive connectivity with retail brokerage firms, we are able to deliver holistic, higher-quality, and more consistent solutions. We believe it takes strategic organizational design, deep existing relationships between retail brokerage firms, and executive management, practice leaders, and individual retail producers, as well as meaningful scale and top-tier talent, to achieve this level of connectivity.

Collaborative relationships with insurance carriers: We align with our carrier trading partners, providing them with access to specialized and often proprietary binding authority and underwriting management capabilities, broad distribution and deep industry expertise. We alleviate our more than 200 carrier trading partners of administrative burdens by offering 22 MGAs/MGUs and our National Programs Platform which together offer commercial insurance for specific product lines or industry classes. The diversity of our offerings enables our carrier trading partners to cost-efficiently access new risk classes in a timely manner, including on a delegated authority basis. We believe our carrier relationships are built on trust, industry credibility, and a proven track record of delivering attractive underwriting results. We work with the largest insurance carriers in the E&S industry, which have consistently provided us long-term capital support. We are trading partners with each of the top 25 U.S. E&S insurance carriers as ranked by AM Best, numerous Lloyd’s syndicates, U.K. and other international insurance companies. As a reflection of the strength of these relationships, our carrier trading partners will refer acquisition candidates to us, or proactively engage with us to develop new programs.

Comprehensive, full service product offering: Our success has been driven by our ability to provide a broad and innovative product offering that continues to meet the needs of our trading partners, regardless of complexity or risk profile. To provide this comprehensive level of service, we have developed a full suite of products, relationships, and capabilities. Our Wholesale Brokerage Producers are highly regarded for their ability to procure coverage for the largest, most complex, and high-hazard risks. Our Wholesale Brokers are able to place policies for challenging risks such as coastal condos, power generators, kidnap and ransom exposures, hospitals, trucking fleets, and waste haulers. Our Binding Authority Producers are renowned for their ability to quickly bind smaller accounts with unique attributes. Our Underwriting Management Specialty offers retail and wholesale brokers a wide assortment of risk solutions for highly specialized needs, such as: renewable energy, construction, cyber, transportation, transactional liability, long-term care facilities, M&A representations and warranties, and catastrophe-exposed properties. Our comprehensive suite of products and services and our broad geographic footprint allow us to place coverage for nearly any risk brought to us by the over 17,000 retail insurance brokerage firms with which we do business. We believe that it would be difficult for a new entrant to replicate the intellectual capital behind the breadth and depth of our product offerings.

Free of channel conflict with retailer brokers: Our fundamental philosophy is that our clients’ interests must always come first. In developing our distribution strategy, we have proactively avoided channel conflicts with our clients, including in retail insurance distribution. Many of our competitors, including some of our largest, have taken a different approach. We believe that the divergence in strategy has facilitated and solidified our presence on the wholesale panels of nearly all of the most significant retail brokerage firms. Our position on numerous wholesale panels and aligned interests with retail insurance brokers enhances our reputation as a destination of choice for the most talented producers, enhances the market opportunity for our existing Producers and cements our position as a source of intellectual capital for insuring specialty risks.

Visionary, iconic, and aligned leadership team: We were founded by Patrick G. Ryan, a widely respected entrepreneur and global insurance leader who previously founded Aon, the second-largest global retail insurance broker, and who served as Aon’s Chairman and/or CEO for 41 years. Mr. Ryan serves as our Chairman and CEO and is joined by an experienced leadership team, each member of which has significant exposure in the wholesale distribution market. For example, Timothy W. Turner began his career in the insurance industry in 1987. Prior to joining Ryan Specialty, he was with CRC Insurance Services, Inc. for 10 years and was its President at the time of

7

his departure. Our management team and employees also have significant alignment with stockholders. As of December 31, 2022, we had over 600 employee stockholders, including all of our top 50 Producers. Our management team and employees remain committed to our vision of market leadership by providing differentiated intellectual capital, building trusted relationships and pioneering risk solutions.

Our Strategy

We intend to grow our business by pursuing the following strategies:

Attract, retain, and develop human capital: Our people are the key to our success, so we have long focused on attracting and developing the most talented professionals in the industry. Since the beginning of 2018, we have recruited 79 Producers who are now responsible for $524 million of annual premiums (figures exclude Producers who are not associated with a discrete book of business). Each of the recruited Producer cohorts of 2016, 2017, 2018, 2019, 2020, and 2021 generated revenue that exceeded compensation costs by their second year. In recent years, we have formalized our production sourcing and development program, which was substantially enhanced by All Risks University, and which has further evolved into Ryan Specialty University. This development platform allows us to cultivate talent across all levels and specialties. We are able to retain new and tenured employees alike by offering unprecedented market access, supporting Producers in growing their books and providing broad opportunities for rapid career advancement within our organization. For example, in 2022 and 2021, 83% and 87%, respectively, of our Producers grew their book of business. Our ability to retain top talent is highlighted by the fact that since the All Risks Acquisition was completed, as of December 31, 2022, retention has been consistent with Ryan Specialty’s historical retention rates.

Lead with innovation in an ever-changing market: We believe that change is inevitable and necessary. Accordingly, our business is built to respond to rapidly shifting market conditions by constantly looking for ways to broaden and enhance our product offerings. For example, many of our 10 de novo MGUs were formed to respond to emerging risks such as life sciences (LifeScienceRisk®), renewable energy (PERse®), excess commercial general liability (Emerald Underwriting Managers), cyber (EmergIn Risk), and professional liability (CorRisk). We developed Ryan Re Underwriting Managers, LLC (“Ryan Re”) to serve as an MGU in collaboration with Nationwide to create new opportunities for both organizations to grow their presence in the specialty lines market, which in turn expanded the reach of our underwriting management services into the reinsurance market. We created The Connector to be a unique technology entrant into the E&S space. The Connector allows us to better serve retail insurance brokers by placing their smaller-premium accounts efficiently, evaluating more of their submissions rapidly, and binding more policies for them cost-effectively. We believe in the relentless pursuit of innovation in order to respond to evolving market conditions and to reach underserved specialty markets. Further to this effort, we acquired Keystone Risk Partners, representing our entrance into the alternative capital market and captive management business. Keystone advances our mission, allowing us to better serve our retail brokers to find innovative solutions for their clients. It also represents a niche growth opportunity in E&S to build and design coverage structures for some of the most complex risks, while allowing insureds greater control over their long-term insurance costs. We have identified the following markets as near-term potential growth opportunities: employee benefits, nursing homes, alternative risk offerings, cyber, transportation, and New York construction and habitational spaces.

Pursue strategic acquisitions and align interests to enhance the network effect: Since our inception, we have a history of successfully executing and integrating acquisitions across a diverse mix of specialties and geographies. Our acquisition strategy is centered on increasing our intellectual capital, distribution reach, and product capabilities, which mutually reinforce one another. We take a consistent and disciplined approach to deal structuring and integration in order to ensure both that our partners are positioned to succeed after the acquisition and interests are aligned between ourselves and our new teammates. When we acquire Wholesale Brokerage businesses, they gain access to over 17,000 retail insurance brokerage firms, including preferred relationships with substantially all of the top 100 retail insurance brokers and exclusive product capabilities. When we acquire Underwriting Managers, they gain access to our wholesale Producers, deep carrier relationships, and visionary leadership. As we continue to grow, these positive network effects become stronger. The connectivity among our Specialties, as well as with key trading partners, enhances the value of our platform to recruited Producers and presents a highly attractive value proposition to acquisition partners.

8

Deepen and broaden our relationships with retail broker trading partners: Retail insurance brokers have multiple wholesale distribution relationships, even those that have consolidated their wholesale panels. We believe we have the ability to transact in even greater volume with nearly all of our existing retail brokerage trading partners. For example, in 2022, our revenue derived from the Top 100 firms (as ranked by Business Insurance) expanded faster than our 2022 organic revenue growth rate of 16.4%. Key to deepening our relationships with retail insurance brokers will be expanding our product offerings and enhancing our geographic footprint through organic initiatives, continued producer hires, and strategic acquisitions. In addition to deepening our relationships with existing clients, we will continue to broaden our footprint by establishing new retail broker trading partner relationships. Beyond the traditional wholesale P&C opportunities, we also expect to continue to expand our alternative risk offerings and develop a wholesale employee benefits specialty.

Build the largest and most comprehensive national binding authority business: We believe that both M&A consolidation and panel consolidation are in nascent stages in the binding authority market, providing us with meaningful growth opportunities. National scale in E&S distribution, underwriting expertise, and broad access to carrier capacity are key to building a cohesive binding authority platform. We have been diligently focused on all three elements and our efforts accelerated with the All Risks Acquisition, which is renowned for its binding authority capabilities. With a nationally scaled binding authority operation, as well as the capabilities existing within our Underwriting Management Specialty, we expect to be able to comprehensively address the opportunities in the delegated authority market, which represented 30% of E&S premiums in 2021 according to AM Best (inclusive of binding authority and program manager business).

Invest in operations, invest in growth: We have heavily invested in building a durable business that is able to adapt to the continuously evolving E&S market. These investments include core operational functions, ongoing new hire efforts, a visionary management team, and a robust acquisition integration effort. In addition, we have amassed a large underlying data set based on the over 2.1 million total policy submissions we receive annually. We expect to leverage this data set to further refine our pricing models, enhance our placement advice, and increase our efficiency. Even while deliberately making these investments, we have been able to generate substantial cash flow and drive operating leverage. We have historically used our cash flow to invest in the business and fund acquisitions. We expect to continue fortifying our platform to support future expansion and sustain significant organic growth.

Our Specialties

Wholesale Brokerage

Our Wholesale Brokerage Specialty is primarily focused on specialty insurance products that retail brokers and carriers have difficulty placing on their own due to the unique nature or size of the risk. Our Wholesale Brokerage professionals are creative and highly skilled problem solvers, assisting retail insurance brokers in crafting customized solutions. We pride ourselves on providing strategic advice, from coverage strategy and conception all the way through claims activity. To achieve optimal client outcomes, our professionals utilize both their expertise and our leading capabilities and resources. For the year ended December 31, 2022, our Wholesale Brokerage Specialty generated $1,129.2 million in net commission and fees, representing 66.0% of our total net commission and fees. Wholesale Brokerage operates predominantly under the brand “RT Specialty.”

Our Wholesale Brokers distribute a wide range and diversified mix of specialty insurance products from insurance carriers to retail insurance brokerage firms. Our largest distribution channels include (among others):

9

Our Wholesale Brokerage Specialty has extensive relationships with blue-chip insurance carriers and retail insurance brokers. With regard to entities that our Wholesale Brokerage Specialty has a relationship with, there are no material concentrations in retail insurance brokers (top five: 27.5% of 2022 revenue), insurance carriers (top five: 22.7% of 2022 revenue), or internal Producers (top five: 18.9% of 2022 revenue). These concentration statistics reflect both Wholesale Brokerage and Binding Authority Specialties, as many producers utilize both placement strategies. During 2022, we conducted business with thousands of retail brokerage firms, including substantially all of the 100 largest United States retail brokers as identified by Business Insurance in 2021. We also work with small to mid-size retail brokerage firms that do not have direct access to certain of the insurance carriers with which we do business. We continue to benefit from the consolidation of wholesale broking relationships by many retail brokers due to our expertise, execution, and absence of conflicts with most retail brokers’ core businesses.

Binding Authority

We believe our Binding Authority Specialty to be among the largest binding authority platforms in the nation. For the year ended December 31, 2022, our Binding Authority Specialty generated $231.0 million in net commission and fees, representing 13.5% of our total net commission and fees. Our Binding Authority Specialty also operates under the brands “RT Specialty” and “RT Binding Authority.”

Binding Authority provides timely and secure access to our carrier trading partners that have granted relatively limited delegated underwriting authority to us through our in-house binding agreements. Much of this business comprises larger-volume, smaller-premium policies with well-defined underwriting criteria that allows us to combine swift turnaround with the authority to secure coverage regardless of the complexity of risk. The ability to quickly process higher volume policies endows us with a significant efficiency advantage over our competitors attempting to individually place each risk.

Our Binding Authority Producers distribute a curated collection of products to our retail insurance broker trading partners. Our industry distribution channels include (among others):

Underwriting Management

Underwriting Management offers insurance carriers cost-effective, specialty market expertise in distinct and complex market niches underserved in today’s marketplace through MGAs and MGUs, which act on behalf of insurance carriers that have given us relatively broad authority to underwrite and bind coverage, as well as critical product design, administrative and distribution responsibilities, for specific risks, and (often proprietary) National Programs that offer commercial and personal insurance for specific product lines or industry classes. Professionals in the Underwriting Management Specialty often have a meaningful percentage of their compensation tied to underwriting performance to align interests with those of our carrier trading partners. For the year ended December 31, 2022, our Underwriting Management Specialty generated $351.6 million in net commission and fees, representing 20.5% of our total net commission and fees. Our Underwriting Management Specialty operates under multiple brands, which are collectively referred to as “Ryan Specialty Underwriting Managers.”

10

Our Underwriting Managers distribute a highly targeted suite of specialty insurance solutions. Our MGAs and MGUs include:

11

Our Organizational Structure

The Company is the sole managing member of New LLC. New LLC was formed as a Delaware limited liability company on April 20, 2021, for the purpose of becoming, subsequent to our IPO, an intermediate holding company between Ryan Specialty Holdings, Inc., and Ryan Specialty, LLC. Pursuant to contribution agreements, on September 30, 2021, the Company, the non-controlling interest LLC Unitholders and New LLC exchanged equity interests in Ryan Specialty, LLC for LLC Common Units in New LLC, with the intent that New LLC be the new holding company for Ryan Specialty, LLC interests. As Ryan Specialty, LLC is substantively the same as New LLC, for the purpose of this document we will refer to both New LLC and Ryan Specialty, LLC as the “LLC”.

Our Resilience Through COVID-19

The COVID-19 pandemic has resulted in a widespread health crisis that negatively affected certain aspects of our business and the markets and communities in which we, our trading partners, and clients operate. It also provided additional opportunities for certain aspects of our business. Against this backdrop, it is noteworthy that the resilience of our operations and the ability to continue to scale our business in most or all environments seems to have been validated. Our leadership took decisive, timely steps aimed at protecting the health and safety of our employees and clients by closing nearly all in-office operations, restricting business travel and transitioning to a remote work environment in mid-March 2020. The investments we made over the years in our culture, trading partner relationships, business, and technology have allowed us to stay on track to exceed performance goals set prior to the pandemic. We began to transition back into the office in the spring of 2022 and have incorporated remote work flexibility into our post-pandemic operating model.

Our Recent Acquisitions

In September 2020, Ryan Specialty acquired 100% of the equity of All Risks, an insurance specialist providing services in wholesale brokerage and delegated underwriting authority, in exchange for consideration of approximately $1.2 billion.

In December 2021, Ryan Specialty acquired Crouse and Associates (“Crouse”) and certain assets of Keystone Risk Partners, LLC (“Keystone”). Crouse became part of RT Specialty which deepens our transportation practice, adds excess and general liability expertise, as well as other property and casualty risks. Keystone expands our offerings to our retail broker and agent trading partners by facilitating access to alternative risk capital.

In January 2023, Ryan Specialty acquired certain assets of Griffin Underwriting Managers, which enhances our market presence in the Pacific Northwest, provides access to new appointments with critical carriers in this market, and allows us to better attract high quality production talent in this market.

Seasonality

Our Wholesale Brokerage and Binding Authority Specialties typically experience higher revenues in the second and fourth calendar quarters of each year, primarily due to the timing of policy renewals. Our Underwriting Management Specialty typically experiences higher revenues in the fourth quarter, primarily due to the timing of policy renewals.

Clients

The insureds served by our clients operate in many businesses and industries throughout the United States, Canada, the United Kingdom, Europe, and certain other countries in which our subsidiaries operate. Our clients are retail brokers and agents, other intermediaries, and insurance carriers. The top five retail brokers in the United States account for 19.0% of our revenue, and no single retail broker accounted for more than 8.9% of total revenue in 2022. No carrier accounted for more than 6.7% of total revenue in 2022 (excluding all Lloyd’s syndicates combined).

Tax Receivable Agreement

We entered into the Tax Receivable Agreement with current and certain former LLC Unitholders substantially concurrent with the IPO. The Tax Receivable Agreement provides for the payment by us to the current and certain

12

former LLC Unitholders, collectively, of 85% of the amount of tax benefits, if any, that we actually realize (or in some circumstances are deemed to realize) as a result of (i) certain increases in the tax basis of assets of the LLC and its subsidiaries resulting from purchases or exchanges of LLC Common Units (“Exchange Tax Attributes”), (ii) certain tax attributes of the LLC and its subsidiaries that existed prior to the IPO (“Pre-IPO M&A Tax Attributes”), (iii) certain favorable “remedial” partnership tax allocations to which we become entitled (if any), and (iv) certain other tax benefits related to our entering into the Tax Receivable Agreement, including certain tax benefits attributable to payments that we make under the Tax Receivable Agreement (“TRA Payment Tax Attributes” and collectively with Exchange Tax Attributes and Pre-IPO M&A Tax Attributes, the “Tax Attributes”). The rights of the current and certain former LLC Unitholders under the Tax Receivable Agreement are assignable. We expect to benefit from the remaining 15% of the tax benefits, if any, that we may actually realize. The actual Tax Attributes, as well as any amounts paid to the current and certain former LLC Unitholders under the Tax Receivable Agreement, will vary depending on a number of factors, including the timing of any future exchanges, the price of shares of our Class A common stock at the time of any future exchanges, the extent to which such exchanges are taxable, and the amount and timing of our income and applicable tax rates. The payment obligations under the Tax Receivable Agreement are obligations of Ryan Specialty Holdings, Inc., and not of the LLC. The Tax Receivable Agreement provides that if (i) certain mergers, asset sales, other forms of business combination or other changes of control were to occur or (ii) we breach any of our material obligations under the Tax Receivable Agreement, then the Tax Receivable Agreement will terminate and our obligations, or our successor’s obligations, to make payments under the Tax Receivable Agreement would accelerate and become immediately due and payable. The amount due and payable in that circumstance is based on certain assumptions, including an assumption that we would have sufficient taxable income to fully utilize all potential future tax benefits that are subject to the Tax Receivable Agreement.

Intellectual Property

We rely on a combination of copyright, trademark, trade dress, and trade secret laws in the United States and other jurisdictions, as well as confidentiality procedures and contractual restrictions, to establish and protect our intellectual property and proprietary rights. These laws, procedures, and restrictions provide only limited protection.

We have applied for trademarks in the United States for “Ryan Specialty” and “RT Specialty” and expect these word marks to be registered in the near future. The logo design for RT Specialty, and numerous of our other brand names and logos, are registered as trademarks in the United States and other jurisdictions. We have also registered numerous internet domain names related to our business. Some of our most important brand names are not yet registered, and we rely on common-law trademark protection to protect this intellectual property.

We enter into agreements with our employees, contractors, clients, partners, and other parties with which we do business to limit access to, and disclosure of, our proprietary information. We cannot assure that the steps we have taken will be sufficient or effective to prevent the unauthorized access, use, copying or the reverse engineering of our proprietary information, including by third parties who may use our proprietary information to develop products and services that compete with ours. Moreover, others may independently develop products or services that are competitive with ours or that infringe on, misappropriate, or otherwise violate our intellectual property and proprietary rights, and policing the unauthorized use of our intellectual property and proprietary rights can be difficult. The enforcement of our intellectual property and proprietary rights also depends on any legal actions we might bring against any such parties being successful, but these actions are costly, time-consuming and may not be successful, even when our rights have been infringed, misappropriated or otherwise violated.

Furthermore, effective copyright, trademark, trade dress, and trade secret protection may not be available in every country in which our products are available, as the laws of some countries do not protect intellectual property and proprietary rights to as great an extent as the laws of the United States. In addition, the legal standards relating to the validity, enforceability, and scope of protection of intellectual property and proprietary rights are uncertain and still evolving.

Companies in the insurance industry may own large numbers of copyrights, trademarks, and other intellectual property and proprietary rights, and these companies and entities have and may in the future request license agreements, threaten litigation or file suit against us based on allegations of infringement, misappropriation or other violations of their intellectual property and proprietary rights.

13

See “Risk Factors — Risks Related to Our Intellectual Property and Cybersecurity” for a more comprehensive description of risks related to our intellectual property.

Regulation

Licensing

Our business activities are subject to licensing requirements and extensive regulation under the laws of the countries in which we operate, as well as state laws. Regulatory authorities in the states or countries in which our operating subsidiaries conduct business may require individual or company licensing to act as producers, brokers, agents, third-party administrators, managing general agents, reinsurance intermediaries, or adjusters.

Under the laws of most states in the United States and most foreign countries, regulatory authorities have relatively broad discretion with respect to granting, renewing, and revoking producers’, brokers’, and agents’ licenses to transact business in such state or country. The operating terms may vary according to the licensing requirements of the particular state or country, which may require that a firm operate in the state or country through a local corporation. Our subsidiaries must comply with laws and regulations of the jurisdictions in which they do business. These laws and regulations are enforced by federal and state agencies in the United States. In the United Kingdom we are regulated by governmental agencies including the Financial Conduct Authority (“FCA”) and Prudential Regulation Authority, and we are licensed and regulated by the Lloyd’s insurance market.

Excess and Surplus Compliance

The E&S market generally provides insurance for businesses that are unable to obtain coverage from Admitted insurance carriers because of their high or complex risk profile or the unique nature or size of the risk. The surplus lines transaction is facilitated through a licensed and regulated surplus lines broker. It is the licensed surplus lines broker that is responsible for: (i) selecting an eligible surplus lines insurer; (ii) reporting the surplus lines transaction to insurance regulators; (iii) remitting the premium tax due on the transaction to state tax authorities; and (iv) assuring compliance with all the requirements of the surplus lines codes. State surplus lines laws, or laws pertaining to non-admitted insurance business, require that surplus lines brokers comply with diligent search/exempt commercial purchaser laws and affidavit/document filing requirements, as well as requiring the collection and paying of any taxes, stamping fees, assessment fees, and other applicable charges on such business. Surplus Lines brokers are often subject to special licensing, surplus lines tax, and/or due diligence requirements by the home state of the insured. Fines for failing to comply with these Surplus Lines requirements, specifically for failing to comply with the surplus lines licensing or due diligence requirements, vary by state but can range to several hundred thousand dollars.

Fiduciary Funds

Insurance authorities in the United States, United Kingdom, and certain other jurisdictions in which our subsidiaries operate have also enacted laws and regulations governing the investment of funds, such as premiums, claims proceeds and surplus lines taxes, held in a fiduciary capacity for others. These laws and regulations generally require the segregation of these fiduciary funds and limit the types of investments that may be made with them.

Broker Compensation

Some states permit insurance agents to charge policy fees, while other states limit or prohibit this practice. Many states regulate to some degree the fees that may be charged by brokers. In recent years, several states considered new legislation or regulations regarding the compensation of brokers by insurance carriers. The proposals ranged in nature from new disclosure requirements to new duties on insurance agents and brokers in dealing with clients.

Privacy

Federal law and the laws of many states require financial institutions to protect the security and confidentiality of client information and to notify customers about their policies and practices relating to collection and disclosure of customer information and their policies relating to protecting the security and confidentiality of that information.

14

Federal law and the laws of many states also regulate disclosures and disposal of customer information. Congress, state legislatures, and regulatory authorities are expected to consider additional regulation relating to privacy and other aspects of customer information.

Competition

The wholesale brokerage business is highly competitive and very fragmented, although there are a limited number of truly national players. Our main competitors are national insurance wholesale brokers, as well as numerous specialist, regional, and local firms in almost every area of our business. We also compete with insurance and reinsurance carriers that market and service their insurance products without the assistance of brokers or agents. Competition also comes from other businesses that do not fall into the categories above, including commercial and investment banks and consultants that provide risk-related services and products.

Key competitive factors in our market include:

We believe that we compete favorably on these factors.

Human Capital Management

Our culture is the foundation of everything we do. Our employees are our greatest asset, and we strive to foster a productive and empowering work environment that embodies our core values: Integrity, Client Centricity, Teamwork, Inclusion, Empowerment, Innovation, and Courage. Our key differentiators are not only our talent and expertise but also the creativity and execution we deliver on behalf of our clients. Our commitment to attracting and retaining top industry talent to assist our clients is matched only by our entrepreneurial spirit and passion for excellence.

As of December 31, 2022, we employed approximately 3,850 people with 94 offices across the United States, Canada, the United Kingdom, and Europe. We also engage temporary employees and consultants and none of our employees are represented by unions. We offer competitive compensation and benefits programs in order to attract and retain top talent. We have high employee engagement and ownership, low turnover and consider our current relationship with our employees to be very good.

We are committed to building, growing, and sustaining a diverse workforce reflective of society throughout the entirety of the organization. Our vision is an inclusive and equitable workplace where all employees are valued and evaluated based on their performance and contributions. Leveraging differences in race/ethnicity, creed, color, religious beliefs, gender identity, sexual orientation, and other diversity demographics, are considered corporate assets, as bringing together varied perspectives, backgrounds, and experiences better serves our clients, trading partners, workforce, and communities. We have recently appointed a Head of Diversity, Equity & Inclusion (DEI) and a Vice President of DEI to further evolve a DEI program where team members will have the opportunity to be involved in, and contribute to create, a culture and environment where people can be their best self and do their best work. We also partner with a number of nonprofit, community, and industry organizations to attract, support, develop, and retain diverse talent.

The development, attraction, and retention of employees is a critical factor in our success. As a result, we have established Ryan Specialty University, which combines best-in-class classroom and on-the-job training practices. Ryan Specialty University provides world class training and development programs for our newest teammates. This formalized institution, along with our substantial summer internship program, is critical to our future growth and ability to continue to recruit the best of the best.

15

Item 1A. Risk Factors

Our operating and financial results are subject to various risks and uncertainties. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, financial condition, operating results and prospects could be materially and adversely affected. Because of the following factors, as well as other factors affecting our businesses, financial condition, operating results and prospects, past financial performance should not be considered a reliable indicator of future performance, and investors should not rely on historical trends to anticipate trends or results in the future.

Risk Factors Summary

Our business is subject to numerous risks and uncertainties and you should carefully consider all the information presented in the section entitled “Risk Factors” in this Annual Report. Some of the principal risks related to our business include the following:

Risks Related to Our Business and Industry

16

Risks Related to Legal and Regulatory Requirements

Risks Related to Our Indebtedness

Risks Related to Our Organizational Structure and our Class A Common Stock

17

These and other risks are more fully described below. If any of these risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected.

Risks Related to Our Business and Industry

If we fail to successfully execute our succession plan for Patrick G. Ryan, our founder, chairman and chief executive officer, or other members of our senior management team, as well as recruit and retain revenue producers, including wholesale brokers and underwriters, we may not be able to execute our business strategy.

Our success depends in a large part upon the continued service of our senior management team, including our founder, chairman and chief executive officer, Patrick G. Ryan, each of whom are critical to our vision, strategic direction, culture, products, and technology. The loss of Mr. Ryan or other members of our senior management team, even temporarily, could materially harm our business.

We could be adversely affected if we fail to successfully execute our succession plan for our senior leaders and key executives, including Mr. Ryan and the acceptance of our trading partners of such plan. While we have succession plans in place and we have employment arrangements with certain key executives, these do not guarantee the services of these executives will continue to be available to us.

Additionally, losing personnel who manage important client and carrier relationships for our products could adversely affect our operations and execution of our future growth strategies. Competition for revenue producers including wholesale brokers and underwriters is intense. Our ability to recruit and retain these professionals is critical to the success of our business. We cannot provide assurance that any of the wholesale brokers or underwriters who leave our firm will comply with the provisions of their employment and stock grant agreements that preclude them from competing with us or soliciting our clients and employees, or that these provisions will be enforceable under applicable law or sufficient to protect us from the loss of any business. The law governing non-compete agreements and other forms of restrictive covenants varies from state to state, and some states might not allow us to enforce some or all of our restrictive covenants. Additionally, on January 5, 2023, the U.S. Federal Trade Commission (“FTC”) issued a notice of proposed rulemaking that would prohibit employers from using non-compete agreements. If enacted, the FTC’s proposed rule would prohibit employers like us from implementing non-compete agreements with our personnel. Further, we do not have employment, non-competition, or non-solicitation agreements with all of our wholesale brokers and underwriters and most of our employment agreements are on “at-will” terms. We may not be able to retain or replace the business generated by key personnel who leave our firm.

We rely on the efficient, uninterrupted, and secure operation of complex information technology systems and networks to operate our business. Any significant system or network disruption due to a breach in the security of our information technology systems could have a negative impact on our reputation, regulatory compliance status, operations, sales, and operating results.

While we manage some of our information technology systems and some are outsourced to third parties, all information technology systems are potentially vulnerable to damage, breakdown or interruption from a variety of sources, including but not limited to cyberattacks, ransomware, malware, security breaches, theft or misuse, unauthorized access or improper actions by insiders or employees, sophisticated nation-state and nation-state-supported actors, natural disasters, terrorism, war, telecommunication, and electrical failures or other compromise. We are at risk of attack by a growing list of adversaries through increasingly sophisticated methods of attack. Because the techniques used to infiltrate or sabotage systems change frequently, we may be unable to anticipate these techniques or implement adequate preventative measures.

For example, in mid-April 2021, we became aware that the Company was the victim of a cyber-phishing event. We confirmed that unauthorized access was gained to the email accounts of five of our employees. In response to this event, the Company took immediate action to secure the compromised email accounts and to prevent the unauthorized person(s) from continuing to have access, or gaining future access, to the Company’s accounts or

18

related information. Additionally, the Company implemented additional employee training to educate and more effectively identify phishing scams and to better understand the purpose and function of the Company’s security applications, which were in operation at the time of this incident. The Company also reassessed and modified its approach to cybersecurity training for newly on-boarded employees and contractors.

Our investigation is complete, and the Company does not believe that the security event was material or that it had a material impact on the Company’s business, operating results or financial condition. We believe we have complied with applicable laws in notifying these individuals, either directly or through substitute notice, offering information, resources and up to two years of credit monitoring, as well as providing proper notice to various governmental departments and agencies and state regulators, including departments of insurance and other such departments or agencies with oversight over regulated insurance entities. If we failed to make such notifications within the timelines required under applicable laws it could result in violations, fines, penalties, litigation, proceedings or enforcement action. In addition, it is possible that state regulators may initiate investigations of the Company in connection with the incident, that the Company could be subject to civil penalties, resolution agreements, monitoring or similar agreements, or third-party claims against the Company, including class-action lawsuits. Moreover, future incidents of this nature that could occur with respect to our systems or the systems of our third-party service providers, as well as any other security incident or other misuse or disclosure of our participant or other data could lead to improper use or disclosure of Company information, including personally identifiable information obtained from our participants, and information from employees. Any such incident or misuse of data could harm our reputation, lead to legal exposure, divert management attention and resources, increase our operating expenses due to the employment of consultants and third-party experts and the purchase of additional security infrastructure, and/or subject us to liability, resulting in increased costs and loss of revenue. In addition, any remediation efforts we undertake may not be successful. The perception that we do not adequately protect the privacy of information of our employees or clients could inhibit our growth and damage our reputation.

If we are unable to maintain and upgrade our system safeguards, we may incur unexpected costs and certain aspects of our systems may become more vulnerable to unauthorized access. While we select our clients and third-party vendors carefully, cyberattacks and security breaches at a client or vendor could adversely affect our ability to deliver products and services to its customers and otherwise conduct its business and could put our systems at risk. Additionally, we are an acquisitive organization and the process of integrating the information systems of the businesses we acquire is complex and exposes us to additional risk as we might not adequately identify weaknesses in the targets’ information systems, which could expose us to unexpected liabilities or make our own systems more vulnerable to attack. These types of incidents affecting us, our clients or our third-party vendors could result in intellectual property or other confidential information being lost or stolen, including client, employee or company data. In addition, we may not be able to detect breaches in our information technology systems or assess the severity or impact of a breach in a timely manner.

We have implemented various measures to manage our risks related to system and network security and disruptions, but a security breach or a significant and extended disruption in the functioning of our information technology systems could damage our reputation and cause us to lose clients, adversely impact our operations and operating results, and require us to incur significant expense to address and remediate or otherwise resolve such issues. In order to maintain the level of security, service, compliance, and reliability that our clients and laws of various jurisdictions require, we will be required to make significant additional investments in our information technology systems on an ongoing basis.

Improper disclosure of confidential, personal or proprietary data, whether due to human error, misuse of information by employees or counterparties, or as a result of cyberattacks, could result in regulatory scrutiny, legal liability or reputation damage, which in turn could have an adverse effect on our reputation, regulatory compliance status, operations, sales and operating results.

We maintain confidential, personal and proprietary information relating to our Company, our employees and our clients. This information includes personally identifiable information, protected health information, and financial information. We are subject to data privacy laws and regulations relating to the collection, use, retention, security and transfer of this information. The inability to adhere to or to successfully implement processes and controls in response to these laws, rules and regulations could impair our reputation, restrict our ability to operate in certain jurisdictions, or result in additional legal liability, which in turn could adversely impact our reputation, regulatory compliance status, operations, sales and operating results.

19

Our business may be harmed if we lose our relationships with retailers, insurance carriers or our other clients and trading partners, we fail to maintain good relationships with retailers, insurance carriers or our other clients or trading partners, we become dependent upon a limited number of retailers, insurance carriers or other clients or trading partners or we fail to develop new retailer, insurance carrier and client or trading partner relationships.

Our business typically enters into contractual relationships with insurance carriers, retailers and other clients or trading partners that are sometimes unique to us, but nonexclusive and terminable on short notice by either party for any reason. In many cases, insurance carriers also have the ability to amend the terms of our agreements unilaterally on short notice.

Insurance carriers may be unwilling to allow us to sell their existing or new insurance products or may amend our agreements with them, for a variety of reasons, including for competitive or regulatory reasons or because of a reluctance to distribute their products through our platform. Insurance carriers may decide to rely on their own internal distribution channels, choose to exclude us from their most profitable or popular products, or decide not to distribute insurance products in individual markets in certain geographies or altogether. The termination or amendment of our relationship with an insurance carrier could reduce the variety of insurance products we offer or our ability to place coverage for certain risks for which we do not have alternative markets. We also could lose a source of, or be paid reduced commissions for, future sales and could lose renewal commissions for past sales. Our business could also be harmed if we fail to develop new insurance carrier relationships.