EXHIBIT 99.2

Ryan specialty Ryan specialty's ACQUISITION OF us assure August 2024 1

EXHIBIT 99.2

Ryan specialty Ryan specialty's ACQUISITION OF us assure August 2024 1

DISCLAIMER Forward-Looking Statements: This presentation by Ryan Specialty Holdings, Inc. (the “Company,” “we,” “us”) contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve substantial risks and uncertainties and that reflect the Company’s current expectations and projections with respect to, among other things, its plans, objectives, and business. These forward-looking statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the proposed transaction and opportunities related thereto, including US Assure's ability to meet certain performance targets or expectations, including organic growth, revenue, contribution to the Company's earnings per share and premium growth, as well as the timing or nature of future operating or financial performance or other events. All forward-looking statements are subject to risks and uncertainties, known and unknown, that may cause actual results to differ materially from those that the Company expected, , including potential adverse reactions or competitive responses to our acquisitions and other transactions, the possibility that the anticipated benefits of our acquisitions are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of acquired assets and operations, the occurrence of any event, change or other circumstances that could give rise to the termination of the US Assure acquisition agreement, risks related to disruption of management time from ongoing business operations due to the transaction and our ability to access or obtain debt financing on terms satisfactory to us or at all.. For more detail on the risk factors that may affect the Company’s results, see the section entitled ‘‘Risk Factors’’ in our most recent annual report on Form 10-K and quarterly reports on 10-Q filed with the SEC, and in other documents filed with, or furnished to, the SEC. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Given these factors, as well as other variables that may affect the Company’s operating results, you are cautioned not to place undue reliance on these forward-looking statements, not to assume that past financial performance will be a reliable indicator of future performance, and not to use historical trends to anticipate results or trends in future periods. The forward-looking statements included in this presentation relate only to events as of the date hereof. We do not undertake, and expressly disclaim, any duty or obligation to update publicly any forward-looking statement after the date of this release, whether as a result of new information, future events, changes in assumptions or otherwise.Market and Industry Data This presentation includes information concerning economic conditions, the Company’s industry, the Company’s markets and the Company’s competitive position that is based on a variety of sources, including information from independent industry analysts and publications, as well as the Company’s own estimates and research. The Company’s estimates are derived from publicly available information released by third party sources, as well as data from its internal research, and are based on such data and the Company’s knowledge of its industry, which the Company believes to be reasonable. The independent industry publications used in this presentation were not prepared on the Company’s behalf. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this presentation.US Assure Data and Non-GAAP Financial Measures This presentation contains certain information about US Assure Insurance Services of FL, Inc. (“US Assure”), including certain unaudited financial information, that has been provided to us by US Assure. US Assure has not prepared information about its business for this presentation or confirmed the accuracy of the information included in this presentation. This presentation contains EBITDA, which is not a measure recognized under generally accepted accounting principles (“GAAP”) in the United States. The Company believes that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and assists in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. The non-GAAP financial information is presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP measures used by other companies. EBITDA has limitations as an analytical tool, respectively, and you should not consider any of these measures either in isolation or as a substitute for other methods of analyzing the results as reported under GAAP. Please see the appendix for a reconciliation of such non-GAAP financial information to the most comparable GAAP measure. Due to the forward looking nature of certain non GAAP measures presented in this presentation, no reconciliations of these non GAAP measure to their most directly comparable GAAP measure are available without unreasonable efforts. This is due to the inherent difficulty of forecasting the timing or amount of various reconciling items that would impact the most directly comparable forward looking GAAP financial measure, that have not yet occurred, are out of the Company’s control and/or cannot be reasonably predicted. Accordingly, such reconciliation is excluded from this presentation. Forward looking non GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. As of the date of this presentation, we do not control US Assure and under these circumstances, we cannot assure you of the accuracy or completeness of the information of US Assure presented herein. 2 Ryan specialty

Transaction highlights Ryan Specialty is acquiring US Assure Insurance Services of FL, Inc. (“US Assure”)Strategic Rationale:Expands Ryan Specialty’s Relationships and Total Addressable Market: US Assure meaningfully increases our footprint in the Programs segment of Delegated Underwriting AuthorityDeepens Capabilities in Attractive Markets: Enhances capability in the attractive SME segment of builder's risk and construction market, which is a major and fast-growing component of US GDPAdds a Strong Online Solution Set: Having placed business on their online portal for over 25 years, US Assure’s distribution portal is a unique asset offering an efficient and cost-effective tool that provides a one-stop solution accessed by over 20,000 brokers and agents, with optionality to distribute more product and drive deeper engagementMakes a Great Business Even Better: US Assure has delivered exceptional underwriting results and offers significant value to brokers through their broad appetite, expertise, and best-in-class knowledge of builder’s risk insurance in the SME segment. We can enhance this business through our track record of achieving productivity improvementsBase purchase price of $1,075 million, funded at closing§Up to $400 million of additional performance-based contingent considerationThe transaction is expected to be immediately accretive to Ryan Specialty’s shareholders 3 ryan spscialty

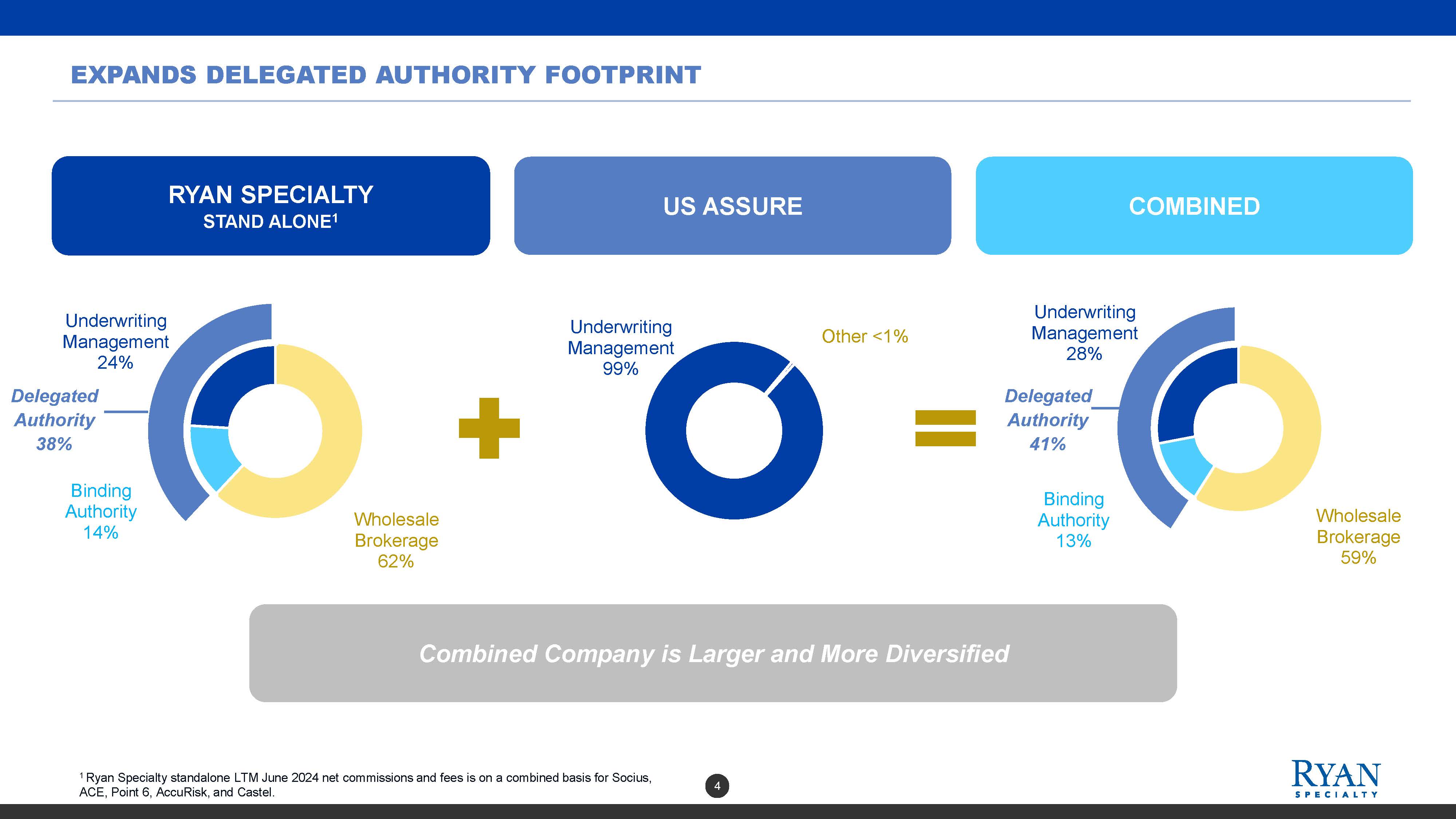

EXPANDS DELEGATED AUTHORITY FOOTPRINT RYAN SPECIALTY STAND ALONE1 US ASSURE COMBINED Underwriting Management 24% Delegated Authority 38% Binding Authority 14% Wholesale Brokerage 62% Underwriting Management 99% Other <1% Underwriting Management 28% Delegated Authority 41% Binding Authority 13% Wholesale Brokerage 59% Combined Company is Larger and More Diversified 1 Ryan Specialty standalone LTM June 2024 net commissions and fees is on a combined basis for Socius ACE, Point 6, AccuRisk, and Castel 4 Ryan Specialty

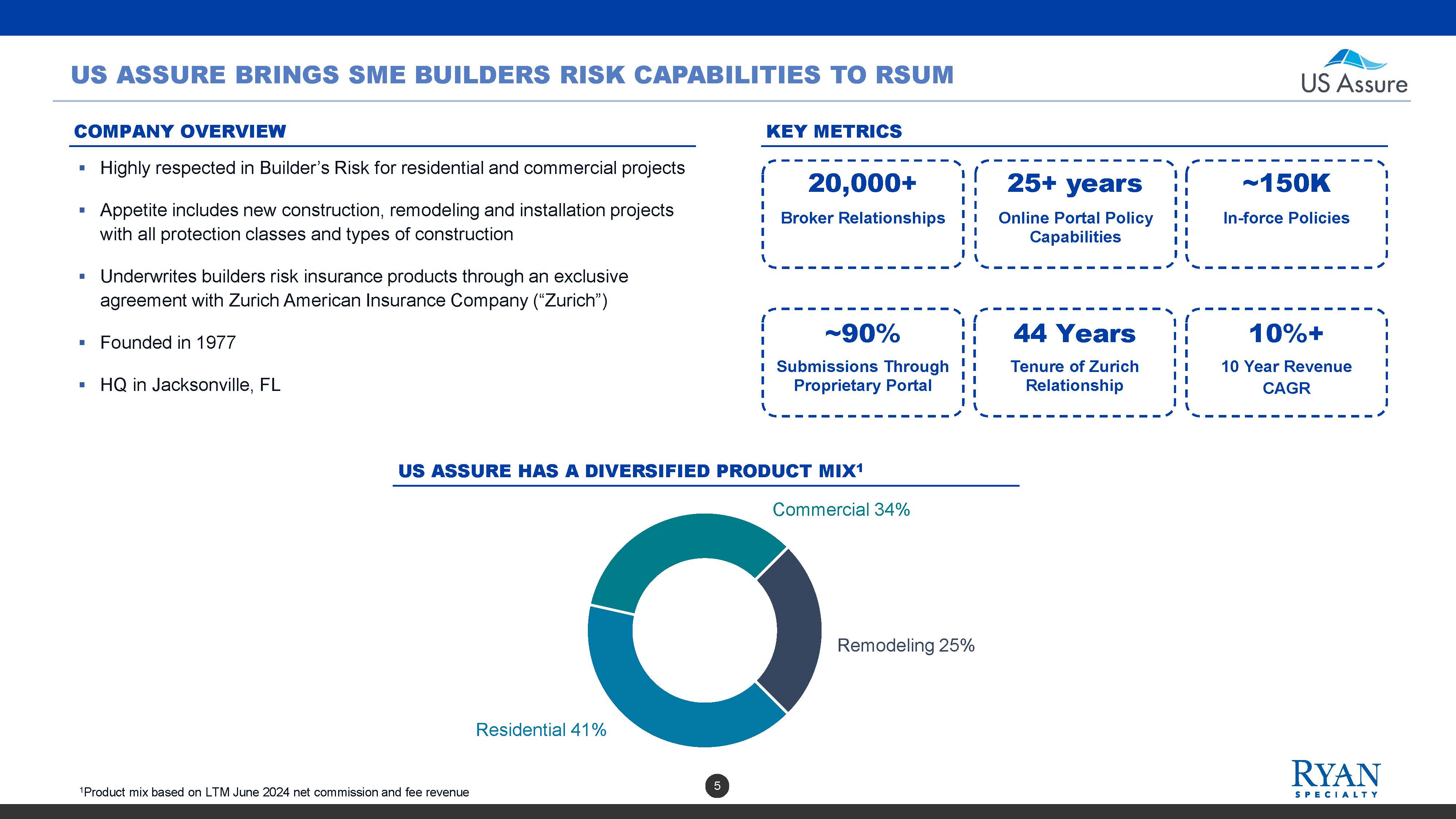

US Assure brings SME BUILDERS RISK capabilities TO RSUM US Assure company Overview Highly respected in Builder’s Risk for residential and commercial projects Appetite includes new construction, remodeling and installation projects with all protection classes and types of construction§Underwrites builders risk insurance products through an exclusive agreement with Zurich American Insurance Company (“Zurich”) Founded in 1977 §HQ in Jacksonville, FL Key Metrics 20,000+ Broker Relationships 25+ years Online Portal Policy Capabilities ~150K In-force Policies ~90% Submissions Through Proprietary Portal 44 Years Tenure of Zurich Relationship 10%+ 10 Year Revenue CAGR US Assure HAS A diversified Product Mix1 Commercial 34% Remodeling 25% Residential 41% 1Product mix based on LTM June 2024 net commission and fee revenue 5 Ryan Specialty

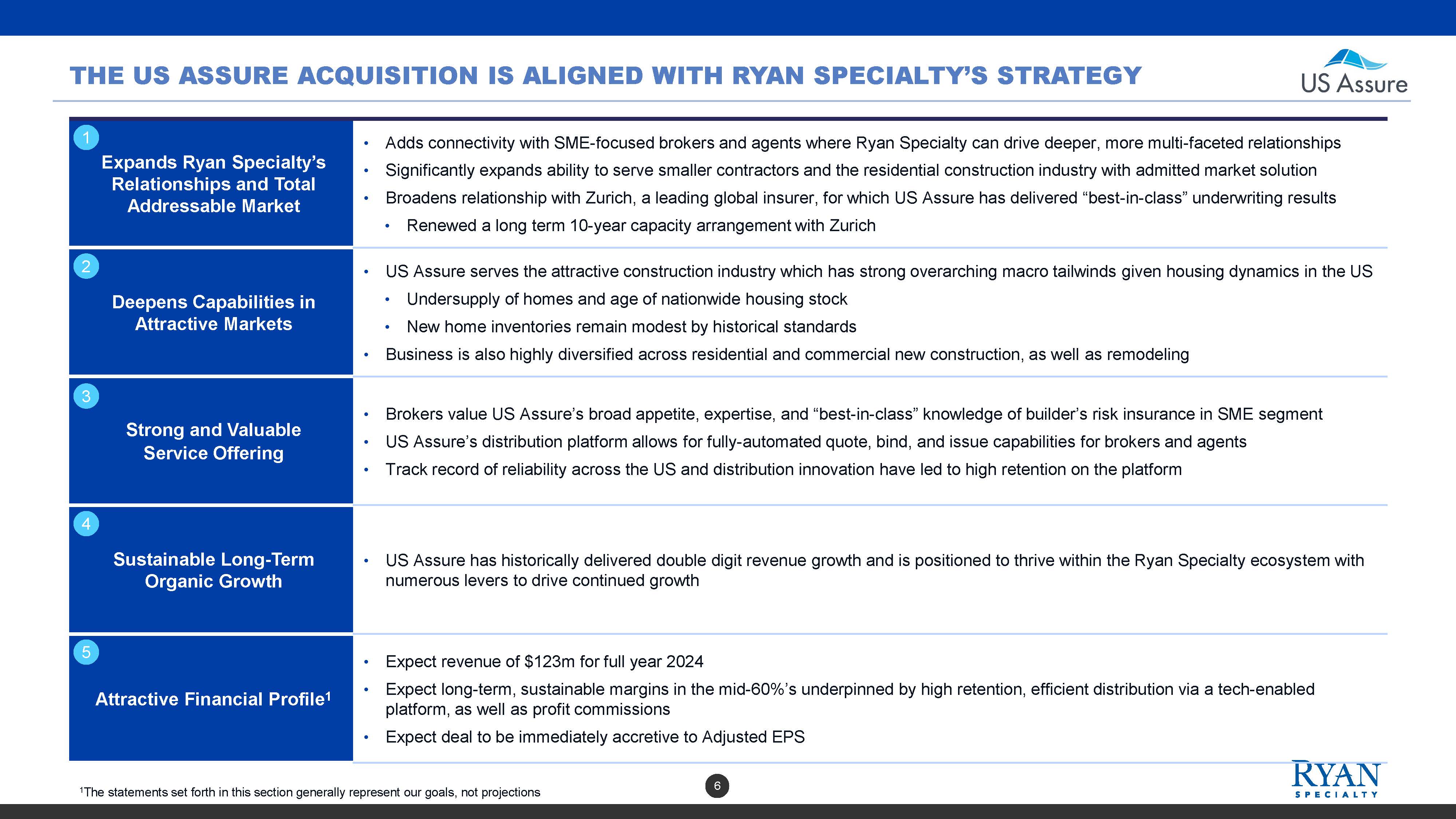

THE US ASSURE Acquisition is Aligned WITH RYAN specialty’S STRATEGY Us Assure Expands Ryan Specialty’s Relationships and Total Addressable Market Adds connectivity with SME-focused brokers and agents where Ryan Specialty can drive deeper, more multi-faceted relationships Significantly expands ability to serve smaller contractors and the residential construction industry with admitted market solution Broadens relationship with Zurich, a leading global insurer, for which US Assure has delivered “best-in-class” underwriting results•Renewed a long term 10-year capacity arrangement with Zurich 1 Deepens Capabilities in Attractive Markets US Assure serves the attractive construction industry which has strong overarching macro tailwinds given housing dynamics in the US Undersupply of homes and age of nationwide housing stock New home inventories remain modest by historical standards Business is also highly diversified across residential and commercial new construction, as well as remodeling 2 Strong and Valuable Service Offering •Brokers value US Assure’s broad appetite, expertise, and “best-in-class” knowledge of builder’s risk insurance in SME segment US Assure’s distribution platform allows for fully-automated quote, bind, and issue capabilities for brokers and agents•Track record of reliability across the US and distribution innovation have led to high retention on the platform 3 Sustainable Long-Term Organic Growth US Assure has historically delivered double digit revenue growth and is positioned to thrive within the Ryan Specialty ecosystem with numerous levers to drive continued growth 4 Attractive Financial Profile1 Expect revenue of $123m for full year 2024•Expect long-term, sustainable margins in the mid-60%’s underpinned by high retention, efficient distribution via a tech-enabled platform, as well as profit commissions Expect deal to be immediately accretive to Adjusted EPS 5 1The statements set forth in this section generally represent our goals, not projections 6 Ryan Specialty

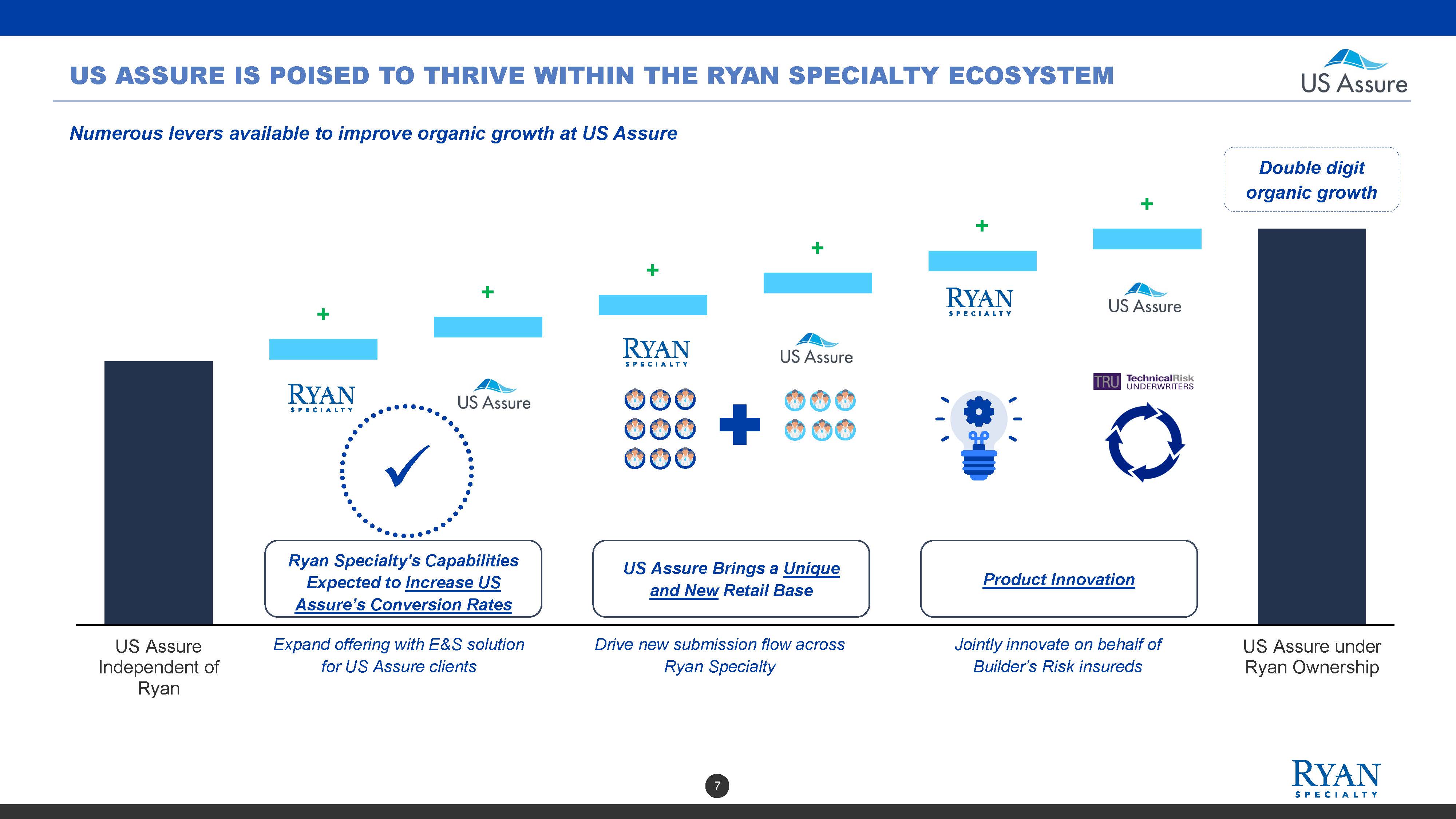

Us assure is poised to thrive within the ryan specialty ecosystem US Assure Numerous levers available to improve organic growth at US Assure Double digit organic growth Ryan Specialty's Capabilities Expected to Increase US Assure’s Conversion Rates US Assure Brings a Unique and New Retail Base Product Innovation Expand offering with E&S solution for US Assure clients Drive new submission flow across Ryan Specialty Jointly innovate on behalf of Builder’s Risk insureds Us assure under ryan ownership us assure independent of ryan 7 ryan specialty + + + + + +tru technical risk underwriters

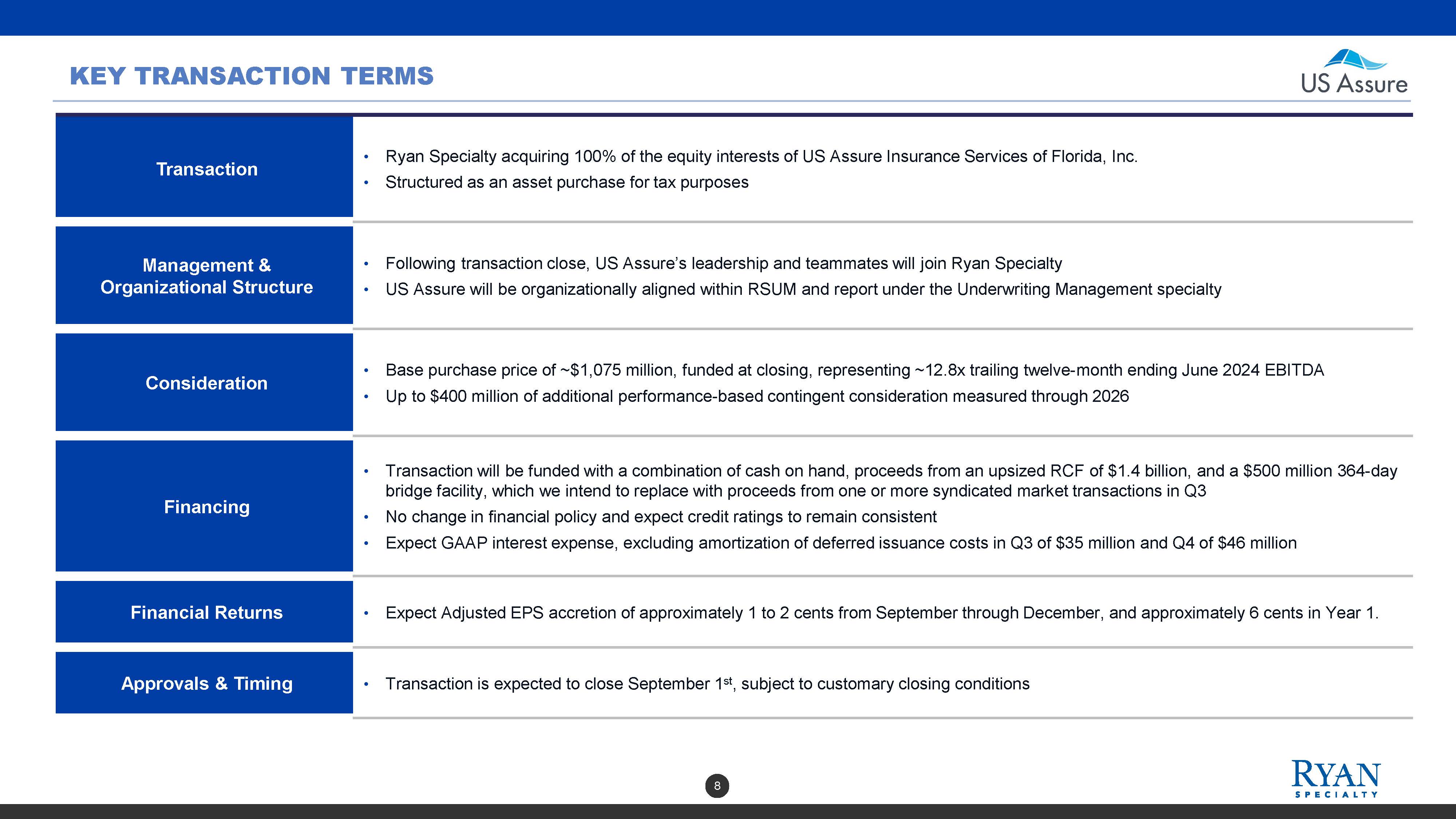

Key transaction terms Us Assure Transaction Ryan Specialty acquiring 100% of the equity interests of US Assure Insurance Services of Florida, Inc.•Structured as an asset purchase for tax purposes Management & Organizational Structure Following transaction close, US Assure’s leadership and teammates will join Ryan Specialty US Assure will be organizationally aligned within RSUM and report under the Underwriting Management specialty Consideration Base purchase price of $1,075 million, funded at closing, representing 12.8x trailing twelve-month ending June 2024 EBITDA Up to $400 million of additional performance-based contingent consideration measured through 2026 Financing Transaction will be funded with a combination of cash on hand, proceeds from an upsized RCF of $1.4 billion, and a $500 million 364-day bridge facility, which we intend to replace with proceeds from one or more syndicated market transactions in Q3 No change in financial policy and expect credit ratings to remain consistent•Expect GAAP interest expense, excluding amortization of deferred issuance costs in Q3 of $35 million and Q4 of $46 million Financial Returns Expect Adjusted EPS accretion of approximately 1 to 2 cents from September through December, and approximately 6 cents in Year 1 Approvals & Timing Transaction is expected to close September 1st, subject to customary closing conditions 8 Ryan specialty

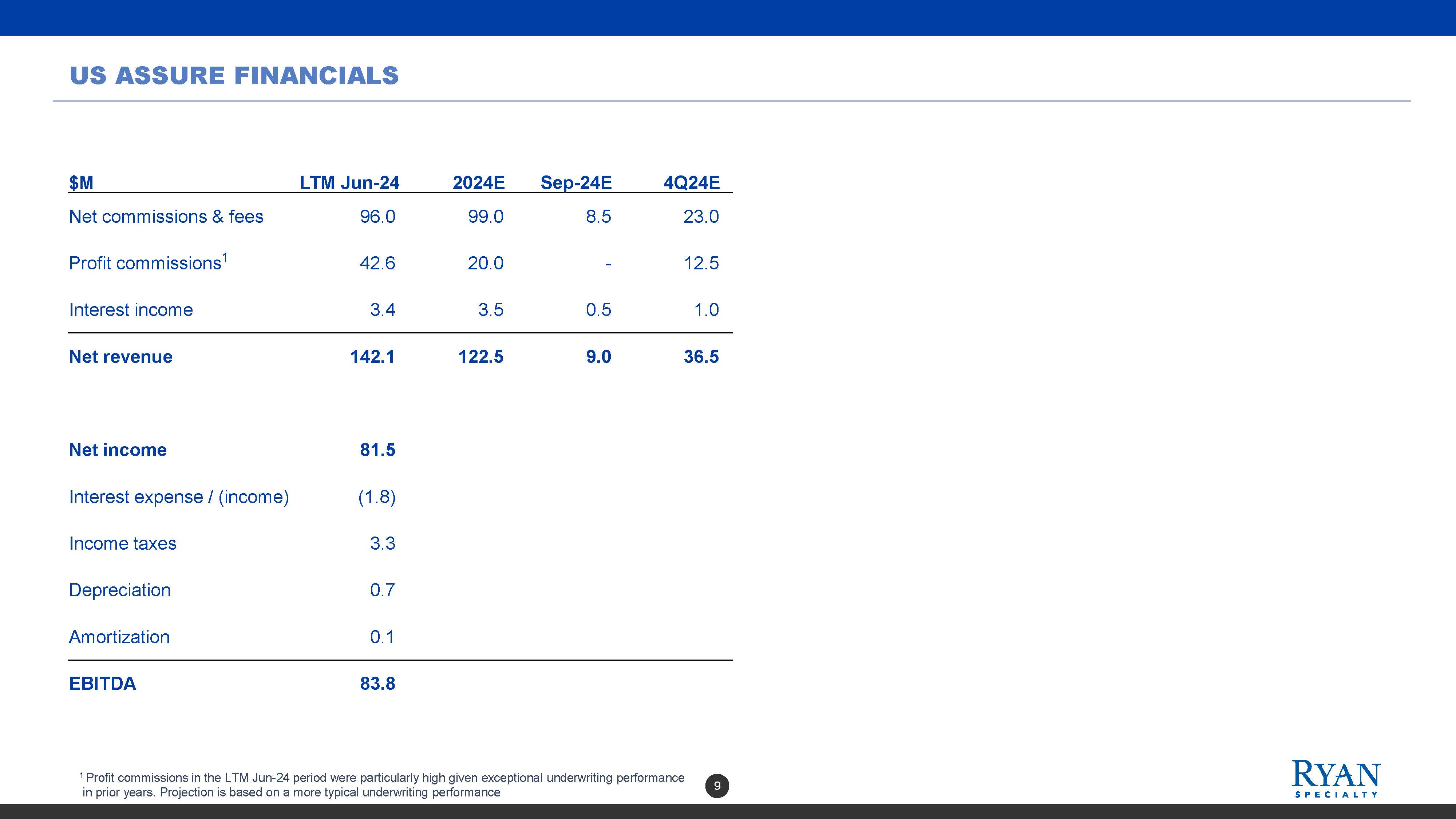

US ASSURE Financials $MLTM Jun-24 2024E Sep-24E 4Q24E Net commissions & fees 96.0 99.0 8.5 23.0 Profit commissions1 42.6 20.0 12.5 Interest income 3.4 3.5 0.5 1.0 Net revenue 142.1 122.5 9.0 36.5 Net income 81.5 Interest expense / (income) (1.8) Income taxes 3.3 Depreciation 0.7 Amortization 0.1 EBITDA 83.8 1 Profit commissions in the LTM Jun-24 period were particularly high given exceptional underwriting performance in prior years. Projection is based on a more typical underwriting performance 9 ryan specialty