The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

Subject to Completion. Dated July 19, 2021

56,918,278 Shares

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Ryan Specialty Group Holdings, Inc., par value $0.001 per share. Ryan Specialty Group Holdings, Inc. is offering 56,918,278 shares of its Class A common stock to be sold in this offering.

Prior to this offering, there has been no public market for the Class A common stock of Ryan Specialty Group Holdings, Inc. It is currently estimated that the initial public offering price per share will be between $22.00 and $25.00. Ryan Specialty Group Holdings, Inc. has applied for its Class A common stock to be listed on the New York Stock Exchange (“NYSE”) under the symbol “RYAN.”

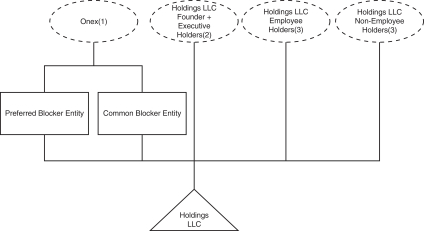

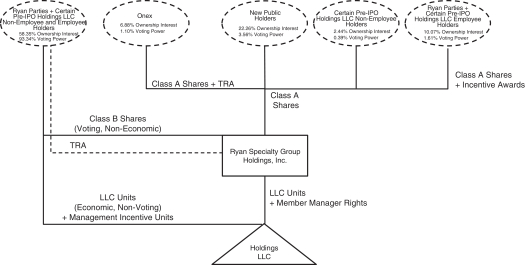

Ryan Specialty Group Holdings, Inc. has two authorized classes of common stock: Class A common stock and Class B common stock (together, the “common stock”). Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is initially entitled to 10 votes per share and, upon the occurrence of certain events, will then be entitled to one vote per share. Following this offering and the completion of the Organizational Transactions described herein, 149,162,107 shares of Class B common stock will be held by the unitholders (other than Ryan Specialty Group Holdings, Inc.) (the “LLC Unitholders”) of Ryan Specialty Group, LLC (“Holdings LLC”), which will be 75.1% controlled by Patrick G. Ryan, our founder, chairman and chief executive officer and certain members of his family and various entities and trusts over which Patrick G. Ryan and his family exercise control (collectively, the “Ryan Parties”). Accordingly, the Ryan Parties will have 70.9% of the voting power of our outstanding capital stock. The Ryan Parties may initially, pursuant to the director nomination agreement that we will enter into with the Ryan Parties in connection with this offering, nominate all but one of the directors of Ryan Specialty Group Holdings, Inc. All holders of Class A common stock and Class B common stock will vote together as a single class except as otherwise required by applicable law or our certificate of incorporation. This offering is being conducted through what is commonly referred to as an “Up-C” structure, which is often used by partnerships and limited liability companies undertaking an initial public offering. The Up-C approach provides the existing owners with the tax advantage of continuing to own interests in a pass-through structure and provides potential future tax benefits for both the public company and the existing owners when they ultimately exchange their pass-through interests for shares of Class A common stock. Following this offering, each of the LLC Unitholders will hold a number of shares of our Class B common stock equal to the number of LLC Units (defined below) each party owns. Holders of Class B common stock do not have any right to receive dividends or distributions upon the liquidation or winding up of Ryan Specialty Group Holdings, Inc.

Ryan Specialty Group Holdings, Inc. intends to use the net proceeds from this offering to (i) purchase outstanding and newly issued non-voting common interest units (such units being the units without any participation thresholds after taking into account the reclassification of all existing units, including existing units with a participation threshold, of Holdings LLC as described in the Organizational Transactions described herein, the “LLC Units”) in Holdings LLC, (ii) purchase preferred units of Holdings LLC held by Onex (as defined herein) through the acquisition of the equity of the Preferred Blocker Entity (as defined herein) (such preferred units will convert to LLC Units immediately thereafter) and (iii) purchase outstanding LLC Units from certain existing holders of LLC Units at a price per LLC Unit equal to the per share initial public offering price of the shares of Class A common stock less the underwriting discounts and commissions referred to below. The number of shares of Class A common stock issued in this offering will be equal to the number of LLC Units held by us after giving effect to the use of proceeds described herein (including the conversion of the preferred units held by the Preferred Blocker Entity to LLC Units). Holdings LLC intends to apply the balance of the net proceeds it receives from Ryan Specialty Group Holdings, Inc. on account of the newly issued LLC Units in connection with this offering to pay expenses incurred in connection with this offering and the other Organizational Transaction and make the TRA Alternative Payments (as defined herein), with the remaining proceeds reserved for general corporate purposes, as described under “Use of Proceeds.” Substantially concurrent with this offering, Holdings LLC also expects to repurchase preferred units held by the Ryan Parties with cash on hand. Upon completion of this offering, Ryan Specialty Group Holdings, Inc. will own 106,488,770 LLC Units, representing a 41.7% economic interest in Holdings LLC and, although Ryan Specialty Group Holdings, Inc. will initially have a